How Gold Value Is Determined by Pawn Shops Explained

Table Of Contents:

💡How Pawn Shops Determine Gold Value

💡Key Takeaways

💡Understanding How Pawn Shops Assess Gold Value

💡The Gold Assessment Process in Pawn Shops

💡The Market for Gold in Pawn Shops

💡Selling Gold at Pawn Shops

💡Alternatives to Pawn Shops for Selling Gold

💡Frequently Asked Questions About Gold Value Assessment

How Pawn Shops Determine Gold Value

Determining the value of gold can be confusing, especially when considering selling it to a pawn shop. This article will explain how pawn shops assess gold value, the assessment process they follow, and the current market trends influencing prices. Readers will gain insights into what factors impact their gold's worth, helping them feel more informed and prepared before visiting a pawn shop. Understanding this process can alleviate the uncertainties many face when trying to sell gold, ensuring they receive a fair offer based on accurate evaluations.

Pawn shops assess gold value based on purity, weight, condition, and market trends

Understanding current market prices helps sellers negotiate better offers for their gold items

Damage affects assessment; minor wear may reduce offers less than severe damage

Good craftsmanship often leads to higher valuations for gold jewelry and items

Essential documentation, like ID and certificates, supports a smooth transaction at pawn shops

Understanding How Pawn Shops Assess Gold Value

Pawn shops assess gold value through several key factors, including pawn loans. They examine the purity of gold, measured by fineness and percentage, to determine its worth. Market trends influence gold prices, while the weight, often measured in grams, plays a critical role in valuation. Additionally, the condition and craftsmanship of items, including gold bars and jewelry, significantly affect their overall assessment.

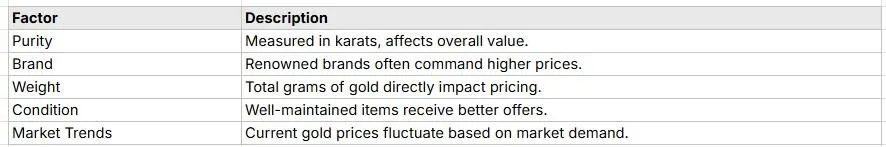

Factors Influencing Gold Valuation in Pawn Shops

When determining the value of gold, pawn shops consider various factors that can significantly impact the price offered to customers. The purity of gold, expressed in karats or fineness, is essential, as higher purity typically translates to a greater value. Brands can also influence evaluation, with items from recognized manufacturers often fetching better prices. For those seeking quick cash solutions, such as smb loans or pawn loans, understanding these factors at a 'pawn shop near me' can help individuals make informed decisions during transactions.

The weight of the gold item is another critical element in assessing its value. Gold is priced based on its weight, and even minor differences can affect the overall offer. Additionally, details like the craftsmanship of jewelry or the condition of bars play a role in determining what a pawnshop will pay. Those looking to sell gold may find it beneficial to research current market trends and report prices to maximize the offer they receive. Understanding these elements can assist customers in navigating the pawnshop buy gold process effectively:

The Role of Gold Purity in Valuation

The purity of gold plays a significant role in how pawn shops assign value to items. Measured in karats or fineness, higher purity means the gold contains a greater percentage of the precious metal, which typically results in a more favorable offer. For instance, a gold coin with a purity of 24 karats is worth more than one with a lower rating, making it a valuable option for individuals looking to sell or pawn their items.

Understanding the impact of purity can help customers navigate transactions at pawn shops effectively. When considering items like bullion or jewelry, it’s essential to know that pawn shops often assess gold value based on purity alongside current market trends. This knowledge enables sellers to make informed choices when deciding to engage in "we buy gold & pawn" transactions:

-Gold purity measured in karats

-Higher purity translates to greater value

-Impact on valuation of coins and bullion

-Importance of market trends

Market Trends Impacting Gold Prices

Market trends have a significant impact on gold prices, affecting how pawn shops evaluate customer items such as scrap gold, wedding rings, and other jewelry. Fluctuations in the global economy, investor demand, and geopolitical events can cause prices to rise or fall. For example, during periods of economic uncertainty, gold often becomes a sought-after asset, increasing its value and leading to better offers for individuals looking to convert their gold into cash.

Pawn shops closely monitor these trends to provide competitive offers to customers. When a vibrant market elevates gold prices, even everyday items—like a video game console with gold components—can yield higher returns. Understanding market conditions empowers customers to make informed decisions while selling or pawning their gold, ensuring they receive a fair price aligned with current evaluations.

The Importance of Weight in Gold Assessment

The weight of gold plays a critical role in its assessment at pawn shops. When evaluating items like jewelry or coins, pawn professionals measure the total grams of the gold, as this directly influences the item's value. Higher weight typically results in better offers, especially since gold is a dense metal, making even small quantities valuable when measured accurately.

Evaluating Gold Condition and Craftsmanship

When pawn shops evaluate the condition and craftsmanship of gold items, they carefully assess factors such as design intricacies and overall wear. For instance, a handbag that features gold embellishments may have varying value based on the quality of craftsmanship and the condition of those elements. High-quality workmanship often leads to a higher valuation, ensuring that sellers gain a better profit margin on their items.

The weight of the gold item, measured in ounces, also plays a significant role in this evaluation process. An item that combines precious metals like gold and silver can offer an additional valuation boost if its overall weight and condition are appealing. Understanding how pawn shops assess the condition and craftsmanship can empower individuals to make informed decisions regarding their gold possessions, maximizing their potential returns during transactions.

Understanding how pawn shops value gold is just the beginning. Next, the gold assessment process reveals the secrets behind each offer made on your precious items.

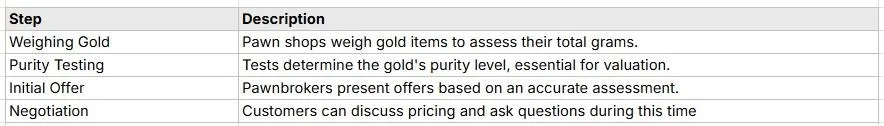

The Gold Assessment Process in Pawn Shops

The gold assessment process in pawn shops involves a series of systematic steps to determine value. Initial consultations include evaluating the gold item, followed by various testing tools and techniques to ensure accuracy. Understanding appraisal methods utilized by professionals and how offers are calculated based on these evaluations will help customers navigate their gold transactions effectively.

Initial Consultation and Evaluation Steps

The initial consultation in the gold assessment process is crucial for both the pawn shop and the customer. During this step, customers present their gold items for evaluation, allowing pawn professionals to examine each piece closely. The assessment begins with a discussion regarding the item's history, which can provide valuable insights into its condition and potential value.

-Initial presentation of gold items.

-Discussion about the item's history.

-Testing for purity and weight.

-Evaluation of craftsmanship and unique features.

Tools and Techniques Used for Gold Testing

Pawn shops utilize a variety of tools and techniques to assess gold items effectively. One primary method involves the use of acid testing kits, which identify gold purity by applying specific acids to the item and observing the reaction. This method allows pawn professionals to classify the gold accurately and provide fair valuations based on its quality.

Another crucial technique is electronic gold testers, which measure the metal's resistance and yield precise readings of purity without damaging the item. These advanced tools offer quick and reliable results, allowing pawn shops to streamline the evaluation process. By employing both traditional and modern testing methods, shops ensure they deliver accurate assessments that reflect true market value, ultimately benefiting customers looking to sell or pawn their gold items.

Understanding Appraisal Methods Utilized

Pawn shops employ a variety of appraisal methods to ensure accurate valuations of gold items. Standard techniques include acid testing, which involves using specific acids to determine the gold's purity by observing any changes that occur when applied. Additionally, electronic gold testers offer a modern alternative by measuring the conductivity of the metal, providing instant and precise readings of purity without damaging the item.

Understanding these appraisal methods allows customers to feel more informed and confident about their transactions. Each technique has its strengths and can accommodate different types of gold items, from jewelry to bullion. By being aware of both traditional and contemporary testing methods, individuals can better grasp how pawn shops ascertain value:

Acid testing for purity determination.

Electronic gold testers for quick assessments.

Combination of techniques for accurate evaluations.

How Pawn Shops Calculate Offers for Gold

Pawn shops calculate offers for gold by using a combination of gold price metrics and evaluation findings from the assessment process. Initially, they reference current market prices for gold per gram, which fluctuate based on supply and demand dynamics. By multiplying this price by the item's weight in grams, pawn shops establish a foundational value that serves as a basis for negotiation.

Further adjustments to the initial valuation incorporate factors such as the item's purity and condition. For instance, a high-purity gold item will typically receive a more favorable offer compared to a lower purity equivalent, reflecting its intrinsic value. Understanding this calculation method allows customers to make informed decisions and prepares them for negotiations when seeking to pawn or sell their gold items.

Once the gold is assessed and valued, the real story begins. The market for gold in pawn shops offers insights into demand and trends that shape every transaction.

The Market for Gold in Pawn Shops

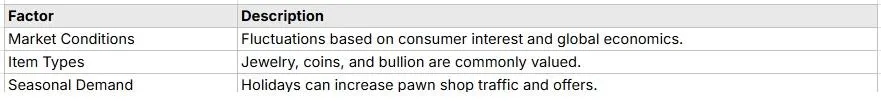

The demand for gold items significantly influences how pawn shops evaluate and purchase them. Commonly bought items range from jewelry and coins to bullion. Customers often hold misconceptions about the selling process and the true value of their gold. Additionally, understanding how high and low seasons affect gold prices can provide crucial insights for those looking to sell, making it essential for individuals to navigate these factors when interacting with pawn services.

Understanding Demand for Gold Items

The demand for gold items in pawn shops often fluctuates based on market conditions and consumer interest. Items such as gold jewelry, coins, and bullion are typically favored by both customers looking for quick cash and shops seeking to maintain a robust inventory. Understanding these trends can help individuals maximize their offers, as pawn shops are likely to pay more for gold items when demand is high.

Additionally, seasonal factors can influence the market for gold. For instance, during holiday periods, pawn shops may experience an uptick in customers seeking cash for gold, which in turn can drive up offers. Being aware of these dynamics allows sellers to time their transactions effectively, potentially leading to better financial outcomes during peak demand times:

Types of Gold Items Frequently Purchased

Pawn shops frequently purchase a variety of gold items, including jewelry, coins, and bullion. Jewelry, often the most common item brought in, can range from simple wedding bands to elaborate pieces, with pawn professionals evaluating their gold content and craftsmanship. Gold coins, especially those with high purity, are also sought after due to their collectible nature and intrinsic value, leading to competitive offers for sellers.

Additionally, gold bullion remains a popular item for pawn shops. These bars and ingots are valued primarily for their weight and purity, making them an appealing choice for those looking to exchange gold for quick cash. Understanding the types of gold items that pawn shops frequently buy can empower sellers to make informed decisions during transactions, ultimately leading to better financial outcomes.

Common Customer Misconceptions About Gold Selling

Many customers hold misconceptions regarding the selling process at pawn shops, often underestimating the true value of their gold items. A common belief is that pawn shops will always offer less than market value, which can discourage potential sellers. In reality, pawn professionals assess the weight, purity, and condition of gold items carefully, allowing them to provide competitive offers aligned with current market trends.

Another misconception involves the perception of specific gold items, such as jewelry or coins. Sellers may assume that sentimental value directly translates to a higher financial offer, but pawn shops focus on the intrinsic value of the gold itself. Understanding this dynamic helps customers approach transactions with realistic expectations, enabling them to make informed decisions about their valuable possessions.

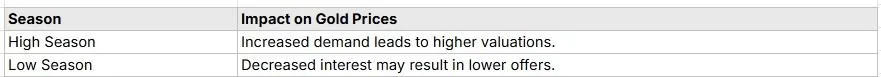

The Impact of High vs. Low Seasons on Gold Prices

Seasonal factors play a critical role in determining gold prices at pawn shops, as demand for gold items can vary significantly throughout the year. During high-demand seasons, such as the holidays, many individuals look for quick cash through selling jewelry, leading pawn shops to offer more competitive prices. This increase in demand can create an environment where sellers receive better valuations for their gold items, making timing important for those looking to maximize their returns.

Conversely, during low-demand seasons, pawn shops may adjust their offers due to a decrease in customer interest. Prices for gold items could potentially drop, as fewer consumers are seeking to sell or exchange these items. It is essential for sellers to be aware of these seasonal fluctuations, as understanding when to approach a pawn shop can impact the value they receive, ensuring more favorable financial outcomes during peak periods:

Gold has always held value, a promise of comfort in tough times. Now, let's explore how selling gold at pawn shops can turn that promise into quick cash when it's needed most.

Selling Gold at Pawn Shops

When selling gold at pawn shops, individuals should consider several important factors to maximize their returns. Tips for getting the best price include understanding current gold values and preparing items for assessment. Buyers can expect a thorough evaluation process and should take the time to compare offers from different pawn shops. Additionally, legal considerations play a crucial role in the selling process, ensuring a smooth and informed transaction.

Tips for Getting the Best Price for Your Gold

To achieve the best price when selling gold at pawn shops, individuals should first familiarize themselves with current gold market values. Understanding the price per gram allows sellers to gauge reasonable offers and negotiate effectively. When presenting their gold items, customers can benefit from demonstrating the quality and condition of the items, as pawn shops prioritize well-maintained pieces for valuation.

Additionally, it's advisable for individuals to shop around and compare offers from different pawn shops. Each shop may evaluate gold items differently based on factors like market demand and inventory needs. By obtaining multiple quotes, sellers can identify competitive prices and make informed decisions that align with their financial goals.

What to Expect During the Selling Process

During the selling process at pawn shops, customers can expect a structured evaluation of their gold items. Initially, pawnbrokers will weigh the gold and test its purity to determine a fair market value. This assessment is quick, often completed within a short time frame, allowing sellers to receive a transparent offer based on their items' specific characteristics.

As the selling process unfolds, the pawnbroker will discuss the valuation with the customer. It is essential for sellers to engage in this conversation, as it provides an opportunity to ask questions about the pricing and factors influencing the offer. Understanding the steps involved and being prepared to negotiate can lead to a more satisfactory outcome, making it crucial for individuals to approach these transactions informed and ready to interact:

Comparing Offers From Different Pawn Shops

When selling gold at pawn shops, comparing offers is a practical step that can significantly impact the financial outcome for sellers. Each pawn shop may have different assessment criteria and pricing strategies, which can lead to varying offers for the same gold items. By obtaining multiple evaluations from different shops, sellers can better understand the market value of their gold and identify the most competitive offer, ensuring they receive a fair price.

This comparison process also allows individuals to gauge the reputation of various pawn shops based on their customer service and transparency in the appraisal process. Engaging with multiple pawnbrokers helps sellers develop a clearer picture of their items' worth while fostering quality negotiation skills. Ultimately, taking the time to compare offers can lead to more satisfactory transactions and greater satisfaction with the selling experience.

Legal Considerations When Selling Gold

When selling gold at pawn shops, individuals should be aware of various legal considerations that can influence the transaction. Laws governing the sale of precious metals vary by location, and sellers may need to provide identification or documentation verifying ownership. Understanding these legal requirements ensures a smoother process, allowing customers to focus on obtaining a fair offer for their gold items.

Moreover, pawnbrokers often adhere to strict regulations concerning the buying and selling of gold. This includes record-keeping practices that protect both the seller and the shop. By grasping the necessary legal protocols, individuals can engage confidently in the selling process, knowing that they are compliant with local laws while maximizing the value received for their gold assets.

Selling gold at pawn shops can bring quick cash, but it’s not the only option available. There are other avenues worth exploring that might offer better returns for your valuable pieces.

Alternatives to Pawn Shops for Selling Gold

Individuals seeking to sell gold have several alternatives beyond pawn shops. Online platforms offer a convenient solution, connecting sellers with broader markets. Comparing local jewelers and pawn shops reveals differing approaches to valuation and pricing. Additionally, private sales can yield higher returns, as they eliminate intermediary fees. Each option provides unique advantages for maximizing gold value.

Online Platforms for Selling Gold

Online platforms for selling gold provide sellers with a convenient alternative to traditional pawn shops. These websites often allow sellers to get valuations based on current market rates, which can sometimes lead to higher offers than local shops. For example, many reputable online dealers evaluate gold items based on weight and purity, giving sellers a clear understanding of their gold's value before committing to a sale.

Furthermore, utilizing online platforms can enhance the selling experience by offering clear guidelines for shipping gold to retailers safely. This option can benefit individuals who may reside in areas with limited access to pawn shops or who prefer a less personal transaction. By opting for online sales, sellers can take advantage of a wider market, potentially increasing the overall return on their gold assets while bypassing the complexities associated with in-person negotiations.

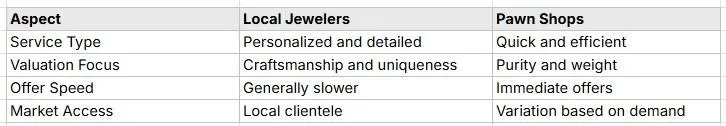

Local Jewelers vs. Pawn Shops for Gold Sales

When comparing local jewelers to pawn shops for gold sales, both options present unique advantages. Local jewelers often provide personalized service and a focus on craftsmanship, which can be beneficial for sellers of high-quality gold jewelry. They may offer competitive prices based on detailed assessments of items, including uniqueness and brand recognition, allowing sellers to potentially receive higher offers.

Pawn shops, on the other hand, tend to emphasize quick transactions, making them a convenient choice for individuals seeking immediate cash. They assess gold value based on standard factors such as purity and weight while often evaluating the item's current market demand. Understanding these differences can help sellers decide which option aligns better with their needs for speed or value:

Advantages of Private Sales

Private sales offer several distinct advantages when it comes to selling gold, allowing individuals to potentially realize a higher value compared to pawn shops. By engaging directly with buyers, sellers can negotiate pricing based on current market conditions and avoid intermediary costs often associated with pawn shop transactions. This personalized approach not only empowers sellers to gain a better understanding of their items' worth but also sets the stage for lucrative negotiations that reflect the true intrinsic value of gold pieces.

Additionally, private sales enable sellers to showcase their gold items effectively, emphasizing unique features and craftsmanship that might not receive adequate attention in pawn shops. For instance, a seller can highlight the artistry of a bespoke jewelry piece directly to an interested buyer, fostering appreciation for its value. This direct connection not only enhances the likelihood of achieving satisfactory financial outcomes but also creates a more personal selling experience, which can be more rewarding than standard transactions at a pawn shop.

As options for selling gold unfold, questions about its true value arise. Delve into the frequently asked queries that can guide every seller in understanding gold’s worth.

Frequently Asked Questions About Gold Value Assessment

This section addresses common inquiries regarding how pawn shops assess gold value. It covers how the gold value is determined and what implications arise if the gold is damaged. Additionally, it explores the possibility of negotiating offers and outlines essential documentation to bring when selling gold. Each topic provides practical insights for individuals seeking clear guidance throughout their selling experience.

How Is the Gold Value Determined?

The value of gold at pawn shops is determined through a systematic approach that considers several key factors. Initially, the purity of the gold, measured in karats, plays a significant role in establishing its worth. Higher purity levels indicate a greater concentration of gold, which typically results in a more favorable offer for sellers seeking to pawn or sell their items.

In addition to purity, the market price of gold significantly influences the overall valuation of gold items. Pawn shops assess current gold prices, which fluctuate based on supply and demand dynamics. By evaluating both the item's weight and condition alongside these market trends, pawn professionals can provide a fair offer that reflects the true value of the gold presented to them:

What if My Gold Is Damaged?

When individuals bring damaged gold items to pawn shops, the potential value can still be assessed, although it may be lower than undamaged pieces. Pawn professionals evaluate the extent of the damage, as minor wear may not significantly affect value, while severe damage may lead to a more substantial reduction in offers. Understanding this can help sellers make informed decisions when it comes to pawning gold that isn't in pristine condition.

Additionally, pawn shops often consider the repairability of damaged gold items. If an item can be restored or repaired, it may still hold significant value compared to non-repairable pieces. Sellers should inquire about potential repairs and ask how these factors will influence the offer:

Can I Negotiate the Offer From the Pawn Shop?

Yes, individuals can negotiate the offer from the pawn shop when selling gold. Understanding the factors that influence gold valuation, such as purity and weight, arms sellers with the knowledge needed to discuss offers confidently. For instance, if the customer has done their research on current gold prices, they can reference this information during negotiations to advocate for a better deal.

Pawnbrokers are often open to discussions, particularly if a seller presents well-maintained and high-quality gold items. Engaging in a polite dialogue about the item's history and condition can further strengthen the case for a more favorable offer. Ultimately, customers who approach negotiations with clear insights and respectful communication are more likely to achieve a satisfactory agreement during their gold selling experience at a pawn shop.

What Documentation Should I Bring When Selling Gold?

When selling gold at pawn shops, individuals should bring specific documentation to ensure a seamless transaction. Essential documents include a valid form of identification, such as a driver's license or passport, which verifies their identity and ownership of the gold items. Additionally, having any certificates of authenticity or previous appraisals can enhance the credibility of the sale and potentially lead to better offers.

Preparing this documentation not only facilitates a quicker evaluation process but also instills confidence in the pawnbrokers. Sellers who present well-organized paperwork will likely receive more respect and attention, making the experience more beneficial. By understanding the importance of these documents, individuals can approach the pawn shop with confidence, knowing they are well-equipped to negotiate effectively and secure a fair value for their gold items.

We Purchase Gold At Higher Values Than Any Of Our Local Competitors

If you have precious metals to sell, HWD Pawn is your premiere destination to sell them in person ANYWHERE in South Florida

We Purchase Gold Jewelry & Trinkets

Our team will pay you based on the value of your gold & silver jewelry and trinkets (i.e. Silverware, etc)

We Purchase Bullion & Portfolios

If you have collections or portfolios of precious metals, we can deploy up to $1 million dollars within 24 hours.

Pawn Shops in Fort Lauderdale Florida: Testimonials From Hollywood Pawn Shop Customers

We take pride in delivering exceptional service and building trust with every transaction. Transparency, fairness, and customer satisfaction are at the core of what we do. Our clients rely on us for secure, competitive pawn loans, and their reviews speak for themselves. Whether you’re a first-time borrower or a returning customer, we strive to exceed expectations. Your trust is our top priority, and we work hard to earn it every day.

Claudia Smith

I want everyone to know that the people that work here and the owner, especially Nick is amazing. They are wonderful people. They’re not people looking to hurt you their people that actually have a heart anyone that needs help and they need to pawn something. I recommend them with all of my heart. God bless.

J.B.

Hollywood Pawn, located at 5224 S State Rd 7, Fort Lauderdale, FL 33314, is a luxury pawn shop specializing in high-end items such as gold, silver, fine jewelry, diamonds, coins, and luxury watches. They offer competitive rates and aim to provide the highest values for your precious metals.

Hollywood Pawn, Fort Lauderdale Pawn Shop: Find Pawnbrokers In South Florida

Our pawn shop is located in the

Twin Shopping Center – North.

We are right next to

Pizza Ricca

and just a short walk from the

Seminole Hard Rock Hotel and Casino.

Feel free to call us with questions or to set an appointment.

Call

Hollywood Pawn

+1 (561) 862-7650

At Hollywood Pawn, we cater to affluent individuals seeking to work with their existing collateral to write high-value loans. We offer many options to buy down your interest rate, and have no pre-payment parameters to pay off your loan.

Shop

+1 (561) 862-7650

© 2025 Hollywood Pawn - All Rights Reserved.

LOAN DISCLOSURES

* To qualify for a 2% Interest rate, loanee must request $50,000 dollars or more, and bring in 3.0X collateral towards the value of that loan.

**To qualify for a reduced 3% Interest rate, loanee must request $20,000 - $49,999 dollars, and bring in 3.5X collateral towards the value of that loan.

**To qualify for a reduced 5% Interest rate, loanee must request $10,000 - $19,999 dollars, and bring in 3.5X collateral towards the value of that loan.nt, recusandae. here

***To buy down your interest rate (as low as 2%) you can add additional collateral.

#We have no time repayment time-limit requirements. As long as you are making your monthly interest payments, your loan can remain open as long as you need.

##Minimum repayment period is 61 days.

###The maximum annual percent rate on properly collateralized loans is 24%APR

####If you loan $10,000 dollars at 2%MIR (Monthly Interest Rate) your maximum APR for a 12-month period would be $2400USD + the principal balance of your loan.

@@@Implications of non-payment: There are no financial implications. If no payment is made the loan simply defaults. Collection practices include sending a text message or email reminding the client payment is due. There is no impact to a client's credit score for late or non-payment. Loans are renewed when an interest payment is made. APR does not exceed 24%. Service fees may apply. There are no additional fees or penalties when renewing a loan. No loans offered are under 60 days. Early prepayment options that are available are not associated with any fees or cost. The loan is not required to be repaid within 60 days. The minimum repayment period is 1 day and maximum is 10 years. An example of a loan is: borrower takes $100, repays $109 in 90 days. Loan is fulfilled.

SELLING METALS DISCLOSURES

* In order to receive 95% - 97% Spot price, you must bring a total of 100g of gold for metal assay testing.

**In order to receive 98% Spot price, you must bring a total of 500g of gold for metal assay testing.

BULLION PURCHASES DISCLOSURES

***In order to purchase gold & silver at 1% premium, minimum purchase amount is 1 KILO of desired metal.

##100% OF ALL PAYMENTS MUST BE MADE VIA BANK WIRE OR ZELLE BEFORE PROCESSING BEGINS

BUSINESS INFORMATION

We are located at 5224 S State Road 7, Fort Lauderdale, FL 33314

Facebook

Instagram

X